5 Simple Techniques For Fresno Cpa

Wiki Article

Accounting Fresno - An Overview

Table of ContentsAn Unbiased View of Certified CpaThe smart Trick of Accountants That Nobody is Talking AboutThe Single Strategy To Use For Accounting FresnoAccountants for DummiesThe Accounting Fresno PDFsSee This Report about Certified AccountantAccountants Fundamentals Explained

The biggest inquiry you should ask on your own, nevertheless, is: What is the finest use your time? Also if you do your own audit, it's very easy to get distracted by the lots of tasks and duties that pound you each day. As you multitask, there is likewise the opportunity of making mistakes in the process, such as an estimation error or a missed purchase.

If all or many of your efforts are made use of in keeping up with tracking your expenses, other divisions in your organization will likely go uncontrolled. Without accurate bookkeeping services, the remainder of your company might be adversely impacted. Various other challenges little organizations deal with can consist of: As your firm does its solutions or produces products for clients, if you're not keeping an eye on your receivables, you may encounter problems with not earning money for the job you're doing within a timely manner.

The Ultimate Guide To Certified Accountant

Enough as well as timely payroll could be the distinction between working with wonderful skill and not taking off in any way. If your organization earns money for the work it creates, your staff members anticipate mutual payment for the job they're doing to maintain business running. While earning money from your accounts is vital, you also need to keep a consistent circulation to pay back your vendors., you want to guarantee you have the most current details on the books for smooth tax obligation preparation. Not only is maintaining track of every expenditure extremely comprehensive, yet you might also end up paying as well much or missing out on out on handy deductibles.

If your publications are inaccurate, or no one is maintaining a close eye on the payroll for consistency and transparency, you could run right into fraudulence instances. A financial audit because of fraud is the last point your business needs. The finest as well as simplest method to fix these common audit obstacles is by employing an accounting professional you can depend deal with the details of your finances.

The Definitive Guide to Certified Cpa

Bookkeepers concentrate largely on keeping track of as well as organising financial transactions. An accounting professional takes a subjective look at your monetary data and what that can imply for your service.While the costs differ, you do finish up saving extra by working with useful link an accountant that can carry out both tasks essential to run your company. As you establish whether you want to involve an accountant, examine the advantages of hiring one.

Placing together a financial method. Developing certified monetary accounts and bookkeeping your firm's books. Accounting professionals aid you keep your overhead expenses down as well as can make forecasts for what's to come monetarily in your company.

A Biased View of Fresno Cpa

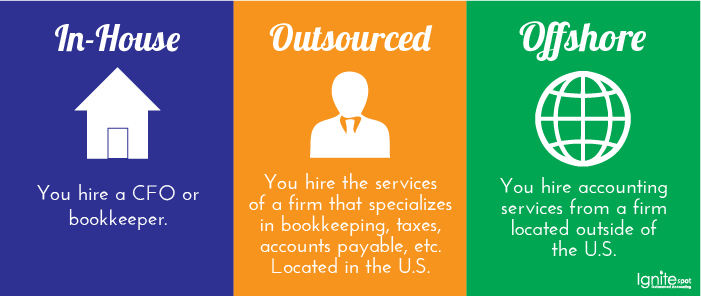

If you observe you may be paying as well click for info a lot for an internal accounting professional. Outsourcing your accounting professional can aid you keep your company agile no matter what financial or societal adjustments occur around you.

We have all of the expertise you're looking for from payroll to service development that can help your company thrive.

Certified public accountants are accountants who are tax obligation specialists. Prior to you begin your organization, you need to consult with a CPA for tax obligation suggestions on which organization framework will certainly save you money and the accounting approach you should use. If you're examined, a certified public accountant can represent you prior to the IRS.As a small company owner, you might locate it hard to assess when to outsource duties or manage them on your own.

Some Known Incorrect Statements About Accounting Fresno

While you can certainly care for the daily accountancy yourself particularly if you have good audit software program or work with an accountant, there are instances when the know-how of a CPA can aid you make audio service decisions, prevent expensive mistakes and also conserve you time. CPAs are tax obligation professionals who can submit your business's tax obligations, answer crucial economic inquiries as well as potentially conserve your service cash.They must take professional education courses how long is the accountant movie to maintain their permit, and also might lose it if they are founded guilty of fraudulence, oversight or ethics infractions. A Certified public accountant is a specialized kind of accountant with tax proficiency who can represent you before the IRS.

If you notice you may be paying too much for an in-house accounting professional. Outsourcing your accountant can assist you maintain your service agile no matter what economic or social changes happen around you.

The Definitive Guide to Accountants

CPAs are accountants who are tax obligation specialists. Prior to you begin your service, you ought to consult with a certified public accountant for tax obligation suggestions on which organization structure will save you cash and the accounting approach you need to make use of. If you're audited, a certified public accountant can represent you prior to the IRS.As a local business owner, you might discover it challenging to gauge when to contract out duties or handle them by yourself.

CPAs are tax obligation experts who can submit your company's tax obligations, solution important monetary questions and also potentially save your company cash.

A Biased View of Accounting Fresno

They have to take specialist education programs to maintain their certificate, and also may shed it if they are founded guilty of scams, carelessness or ethics offenses. Certified public accountants have endless representation rights to discuss with the internal revenue service on your part. A CPA is a customized kind of accountant with tax expertise that can represent you prior to the internal revenue service. certified accountant.Report this wiki page